Insolvency surge isn’t over just yet

Summary

- In most markets, insolvencies have either returned to or exceed pre-pandemic levels. This adjustment, combined with a worsening economic environment, has resulted in relatively high insolvency levels in most markets. But there are also countries where the insolvency level is still below the pre-pandemic level.

- Globally, we anticipate a 23% increase in insolvencies in 2024, followed by a slight decline in 2025.

- In 2024, we expect significant increases in countries that are adjusting from low insolvency levels or experiencing spikes, such as Australia, New Zealand, Sweden, Canada, the Netherlands, and the United States. Denmark is the only country with a substantial decrease.

- The picture for 2025 is more stable as insolvencies are mostly driven by GDP dynamics. Some countries that experienced a spike in insolvencies due to higher interest rates and weak GDP growth are forecast to see declines.

Global insolvencies are expected to increase by 23% in 2024, followed by a minor decline in 2025. For the majority of countries, insolvencies are increasing this year. This is partly a post-pandemic adjustment driven by the loss of large-scale government support. Another reason, however, is the weak economic environment in combination with tightened credit conditions. Cash reserves built up by firms after the pandemic are now under pressure due to shrinking profit margins and tighter funding conditions. The increased debt burden, accumulated during the pandemic, is becoming harder to service in an environment with higher interest rates and lower growth.

In a number of markets insolvencies already reached a level above normality. In some markets, like the UK and Switzerland, insolvencies are stabilising at an adverse new normal, while in other markets, like Austria, Canada and Sweden, there is a temporary spike in insolvencies in 2024.

The global economy is expected to show a moderate expansion of 2.7% this year. While GDP growth is steady, it remains low by historical standards as past monetary tightening weighs on demand. Despite a relatively slow start to the year, the US economic outlook for 2024 remains positive. The risks in the US economy seem finely balanced and a gradual slowdown through the rest of the year is the most likely scenario.

In the eurozone, growth is expected to remain sluggish this year. Countries in Southern Europe, such as Spain, Portugal and Greece, are doing relatively well, due to a growing tourism sector, recovery in the labour market, and fiscal support as part of the NextGenerationEU plans. Germany remains a weak spot due to its sluggish manufacturing sector. The growth picture in 2025 is looking slightly better for the eurozone as a more benign inflationary environment supports consumers’ purchasing power.

Bank lending surveys in both the US and eurozone still show a further tightening of lending standards for companies in the coming months. Eurozone banks reported a small further tightening of credit standards in Q2 of 2024. Similarly, US banks also modestly tightened standards on company loans in the second quarter. Both eurozone and the US banks cite a more uncertain economic outlook as the main reason behind the tightening of funding standards. Together with squeezed profit margins this is weighing on firms’ cash buffers and leads them to operate in a more challenging economic environment.

Insolvencies continued to climb up in most markets

Globally insolvencies increased by 31% year-on-year in 2023 and they continued to increase in the first half of 2024. Out of the 29 markets that we monitor in this report, 23 have adjusted fully back to normal or are even overshooting the pre-pandemic insolvency levels. We consider a market as having fully adjusted back to normal if the insolvency level is at least 95% of the 2019 level. Therefore, at this moment only in a minority of markets the adjustment back to normal is still underway.

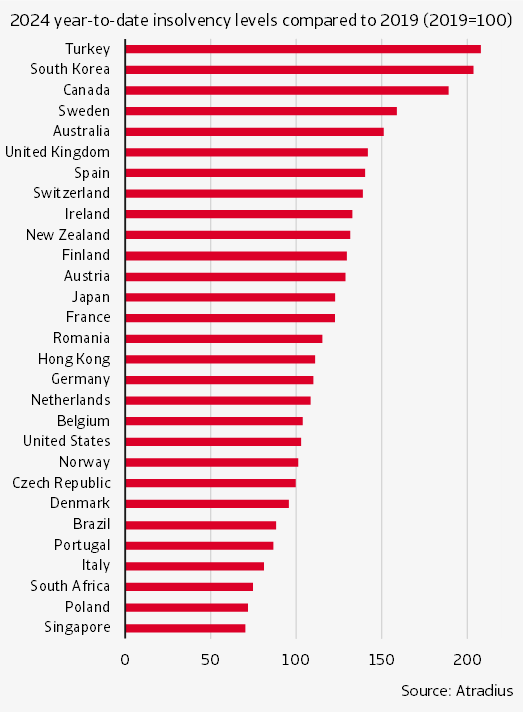

Figure 1 gives the year-to-date insolvencies index in 2024. A value above 100 indicates that the insolvency level is above the (pre-pandemic) 2019 level. A value below 100 means that the insolvency level is still lower than in 2019.

Countries like Turkey, South Korea, Canada, Sweden, and Australia have relatively high insolvency levels in 2024 compared to 2019. While each country faces unique economic challenges, some common factors contribute to the trend. In Turkey, the economy is slowing considerably in 2024 as the government has started to increase taxes and interest rates and is limiting access to credit. The growth slowdown and still-high interest rates is creating a challenging environment for the debt-burdened private sector to operate in. For South Korea, high corporate debt in combination with higher interest rates is weighing on the business environment. In Canada, companies are facing several challenges such as having to repay government loans taken out during Covid, high input costs and high labour costs. In Sweden, high insolvencies are attributed to the economic recession, high interest rates and high costs. A similar picture arises in Australia: weak consumer spending and high input costs squeeze companies’ profit margins, driving up insolvencies. Another factor that is contributing to Australian insolvencies is that the Australian Taxation Office is pursuing debts that were previously put on hold during the Covid pandemic.

Figure 1 Insolvency levels in 2024 year-to-date relative to pre-pandemic

Countries with low insolvency levels compared to pre-pandemic include Singapore, Poland, South Africa, Italy, and Portugal. Generous government support during the Covid pandemic played its role here, such as in Italy and Singapore. This helped firms strengthen their liquidity and cash reserves, preventing a sharp rise in insolvencies after the support was withdrawn. In the case of Italy and Poland, the low insolvency levels are also partly attributed to new regulations that facilitate out-of-court company restructurings.

Outlook 2024 and 2025

We now turn to our insolvency forecast for 2024 and 2025, which are given in year-on-year percentage changes (e.g., total for 2024 compared with total for 2023.

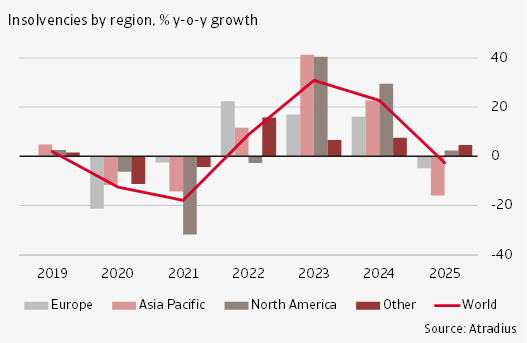

Figure 2 presents our forecasts aggregated for all markets and on a regional level. Globally, we predict that insolvencies increase by 23% year-on-year in 2024.

We foresee a relatively strong increase of insolvencies in North America (29%), which is virtually driven by the United States. For Asia Pacific we predict an increase of 23%; all the observed markets in this region are forecast to see increases in 2024, which can be largely attributed to a regional growth slowdown driven mostly by China. For Europe, we expect a somewhat smaller increase of 16% as the process of normalisation of insolvencies is in an advanced stage in most European countries. We also do not expect – with a few exceptions – a spike of insolvencies in 2024 that far exceeds the pre-pandemic level. In 2025 we see insolvencies slightly decreasing by 3% globally, reflecting decreases in Europe and Asia Pacific. A minor increase in insolvencies is expected in North America next year.

Figure 2 Across regions, insolvencies in 2024 are expected to increase the most in North America

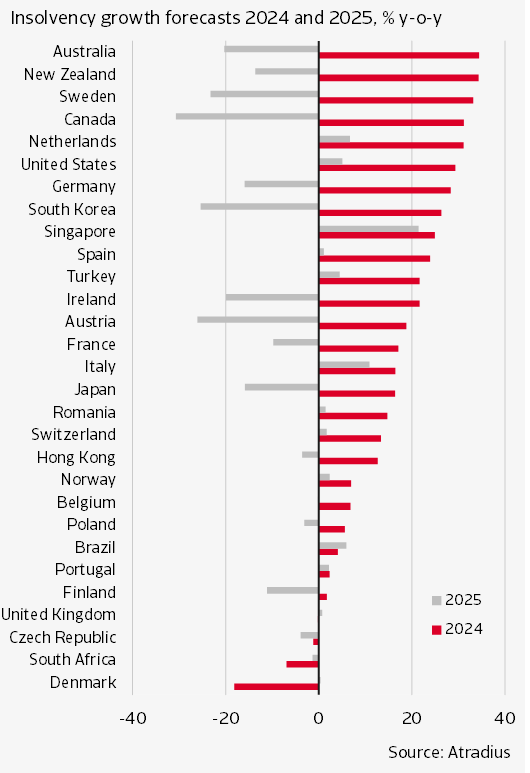

Figure 3 presents our insolvency forecast for 2024 and 2025 on a country level. The markets are arranged in the order of the 2024 growth rate. Countries with a high percentage increase in insolvencies in 2024 include Australia, New Zealand, Sweden, Canada, the Netherlands, and the United States. All experienced a sharp rise in the first half of the year, pushing insolvency levels above pre-pandemic figures. In Australia, New Zealand, Canada, and Sweden, insolvencies have significantly surpassed pre-pandemic levels, indicating that factors beyond a return to normal are driving the increase. These include worsening economic conditions such as weakening growth, high interest rates, and inflation, as well as the repayment of Covid-related loans and/or deferred taxes owed to governments. In the Netherlands, in the first half of 2024, there was a strong upward movement in the number of insolvencies. Insolvencies are now roughly back at the pre-pandemic level. For the year as a whole, we expect a rather strong increase, driven by also by the challenging economic environment and the requirement for Dutch companies to repay deferred taxes.

However, some markets are expected to see a decline or relatively stable insolvency levels in 2024. Denmark is forecasted to experience a significant drop, as insolvencies, which rose above pre-pandemic levels in 2023, have now returned to more normal levels. In countries like the Czech Republic, United Kingdom, Finland, and Portugal, the insolvency development is expected to remain stable. In the UK, insolvencies have settled at a higher level in the near term due to post-Brexit economic weakness, and this is only expected to slowly taper off in the coming years. In Portugal, insolvencies appear to have settled on a lower level compared to pre-pandemic.

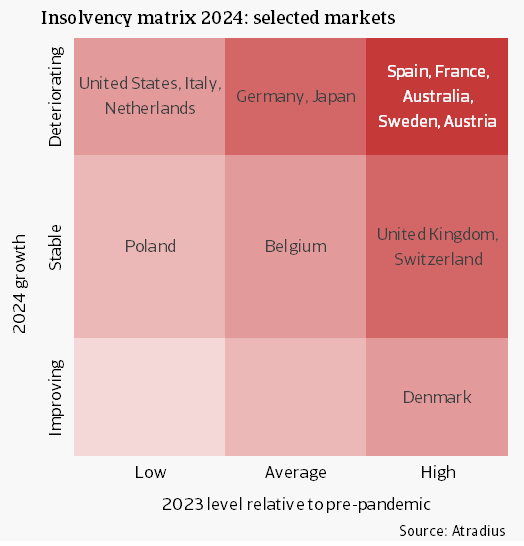

Figure 4 presents insolvency developments across another dimension. The vertical axis of the matrix shows the year-on-year expected change in insolvencies for 2024 compared to 2023. Growth is classified as ‘deteriorating’ if it exceeds 15%, ‘stable’ if it ranges between -15% and +15%, and ‘improving’ if it is lower than -15%. The horizontal axis groups countries by their 2023 insolvency level relative to the pre-pandemic period. Levels are considered ‘high’ if above 105% of 2019 levels, ‘average’ if between 95% and 105%, and ‘low’ if below 95%.

Figure 3 In 2024 we see rising insolvencies in most markets due to a post-pandemic adjustment in combination with a weaker economic environment

Several countries, including Italy, Poland, Belgium, the United Kingdom, and Switzerland, are experiencing stable insolvency conditions, with changes between -15% and +15% in 2024. Notably, the UK and Switzerland stand out due to relatively high insolvency levels, namely 147% of the pre-pandemic level for the UK and 125% for Switzerland.

Another group of countries see a tendency for bankruptcies to deteriorate in 2024. For the United States, the Netherlands and Italy this deterioration is relative to a low 2023 level compared to pre-pandemic. Germany and Japan also see a deterioration, combined with an ‘average’ level of insolvencies. The group in the most upper right corner includes countries with deteriorating insolvency dynamics in 2024, combined with an already ‘high’ insolvency level. This group includes Spain, France, Australia, Sweden and Austria. The only country with an improving trend is Denmark, where insolvencies spiked in 2023, but have been declining in 2024.

Figure 4 Insolvencies deteriorate in 2024 in most markets, including several markets that already had a high level at the start of the year

Our insolvency forecast for 2025 is mostly associated with a normalised environment in which insolvencies are driven by the dynamics in GDP. As monetary policy eases and the economic climate stabilises, the trend in insolvencies is likely to show an improvement next year. Globally, the insolvency trend is roughly stable (-3% year-on-year).

In over half of the markets, we expect a decrease in insolvencies. Some of the sharpest declines are forecasted in countries that experienced a spike in 2024, including Canada, Austria, South Korea, Sweden, and Australia. Absent another economic shock, we expect insolvencies in these countries to normalize to lower levels.

For many markets the insolvency trend is broadly stable in 2025. In these markets insolvencies have settled on the normality level, which is often close to the pre-pandemic level. Examples are Belgium, Czech Republic, Hong Kong, Romania, Spain and Norway.

Switzerland and the United Kingdom have a stable insolvency development in 2025, but at the same time insolvencies have settled on a higher level than pre-pandemic. Conversely, Portugal has settled on a lower level than pre-pandemic. However, in the United States, the Netherlands, Italy and Singapore insolvencies are expected to rise by over 5% year-on-year, still driven by a return to normality.

To conclude, 2024 is likely to remain challenging for firms, due to weaker economic conditions in combination with ongoing post-pandemic adjustments. However, looking ahead to 2025, there is cautious optimism for a gradual improvement in the insolvency landscape, as interest rates are projected to decline, and economic growth is likely to gain modest momentum. These factors should ease financial pressures on firms, allowing for a more stable operating environment.

Theo Smid, Senior Economist

theo.smid@atradius.com

+31 20 553 2169

Iulian Ciobica, Economist

iulian.ciobica@atradius.com

+31 20 553 2121

Ona Čiočytė, Economist

ona.ciocyte@atradius.com

+31 20 553 2149

Relaterade dokument

191.0KB PDF